One platform for all receivables from

Balance to Recovery

A powerful intelligent omni-channel platform that unifies reminders, payments, and collections, automating engagement to convert every receivable into predictable revenue.

Every year, businesses lose up to 30% of receivables.

It's caused by delays, aging balances, and vendor

inefficiencies.

Agile brings a smarter model — using modern automation, real-time data, and AI-powered outreach to take control of receivables from day one, accelerate payments, and eliminate revenue leaks before they happen.

Smart, seamless debt recovery across

your entire portfolio

Products & Services

Full Lifecycle Receivables

Automation

Agile Receivables powers the complete accounts receivable lifecycle — from proactive engagement to recovery execution — through AI-driven, omni-channel automation.

Payment Reminders

Proactive Engagement That Prevents Delinquency

Automate intelligent, AI-powered payment reminders across SMS, email, AI voice, voicemail drops, and secure payment links. Agile helps businesses reduce late payments before accounts become delinquent — improving cash flow while enhancing customer experience.

- Automated reminder scheduling

- Smart payment link delivery

- Behavioral-based engagement optimization

- Real-time tracking & reporting

- Compliance-first communication architecture

Early-Out Programs

Resolve Delinquency Before Escalation

Seamlessly transition past-due accounts into structured, AI-driven early-stage outreach designed to recover balances quickly and reduce roll rates. Agile automates multi-channel engagement while maintaining customer relationships.

- AI-optimized communication cadence

- SMS, email, voice & mail orchestration

- Escalation workflows

- Payment plan enablement

- Performance analytics & recovery insights

First-Party Collections

Recover Revenue Without Losing Control

Empower internal teams with intelligent, omni-channel outreach tools to maximize recovery while protecting brand reputation. Agile enables structured first-party recovery workflows — from soft outreach to advanced escalation — all within a unified platform.

- AI conversational voice outreach

- Automated campaign management

- Customer response tracking

- Secure payment processing

- Compliance-aligned messaging controls

Third-Party Collections

Structured Recovery Through Strategic Partnerships

Agile will extend recovery beyond first-party efforts through a curated network of vetted third-party collection partners. Using Agile's platform, accounts can transition seamlessly into structured third-party execution — with continued performance visibility, compliance oversight, and centralized reporting.

- Partnership-driven recovery model

- Seamless account transition

- Performance visibility & compliance oversight

- Centralized reporting

- Scalable recovery with transparency

Legal Collections

Escalation with Strategic Oversight

Agile's upcoming legal collections framework will support structured placement with vetted legal partners, ensuring compliant, performance-driven recovery for advanced-stage accounts.

Debt Buying & Selling Platform

A Smarter Marketplace for Portfolio Transactions

Agile is building a secure platform to facilitate compliant debt portfolio buying and selling — providing transparency, structured data exchange, and AI-driven valuation insights. Designed for lenders, agencies, and institutional buyers seeking smarter portfolio transactions.

One Platform. Full Lifecycle.

From proactive reminders to recovery execution and future portfolio monetization, Agile is building the modern infrastructure for receivables automation.

Agile in Action

See how Agile empowers your receivables management across every touchpoint

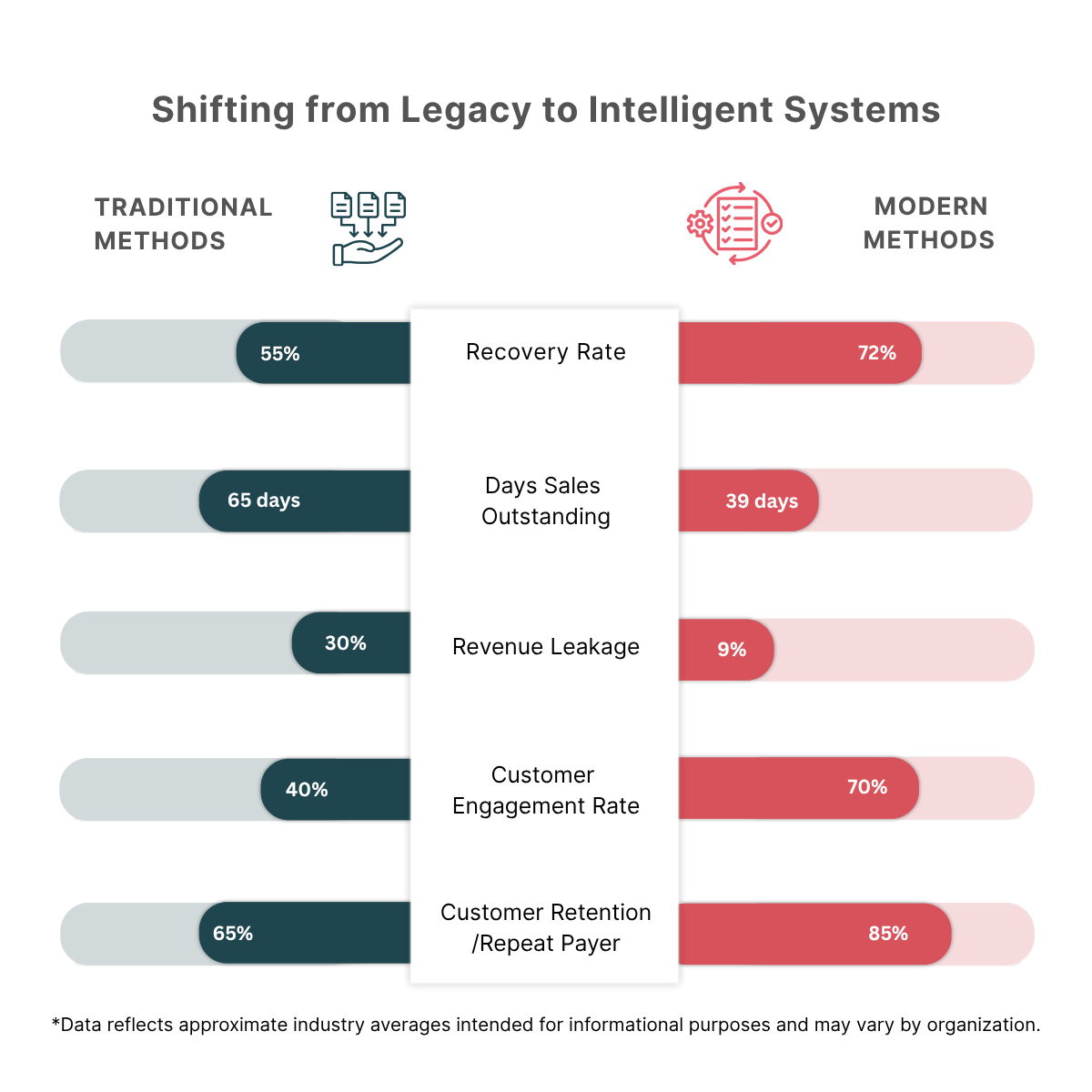

How Agile Receivables Reduces Leakage

Agile Receivables reduces leakage at every stage with predictive outreach, intelligent prioritization, and smart escalation.

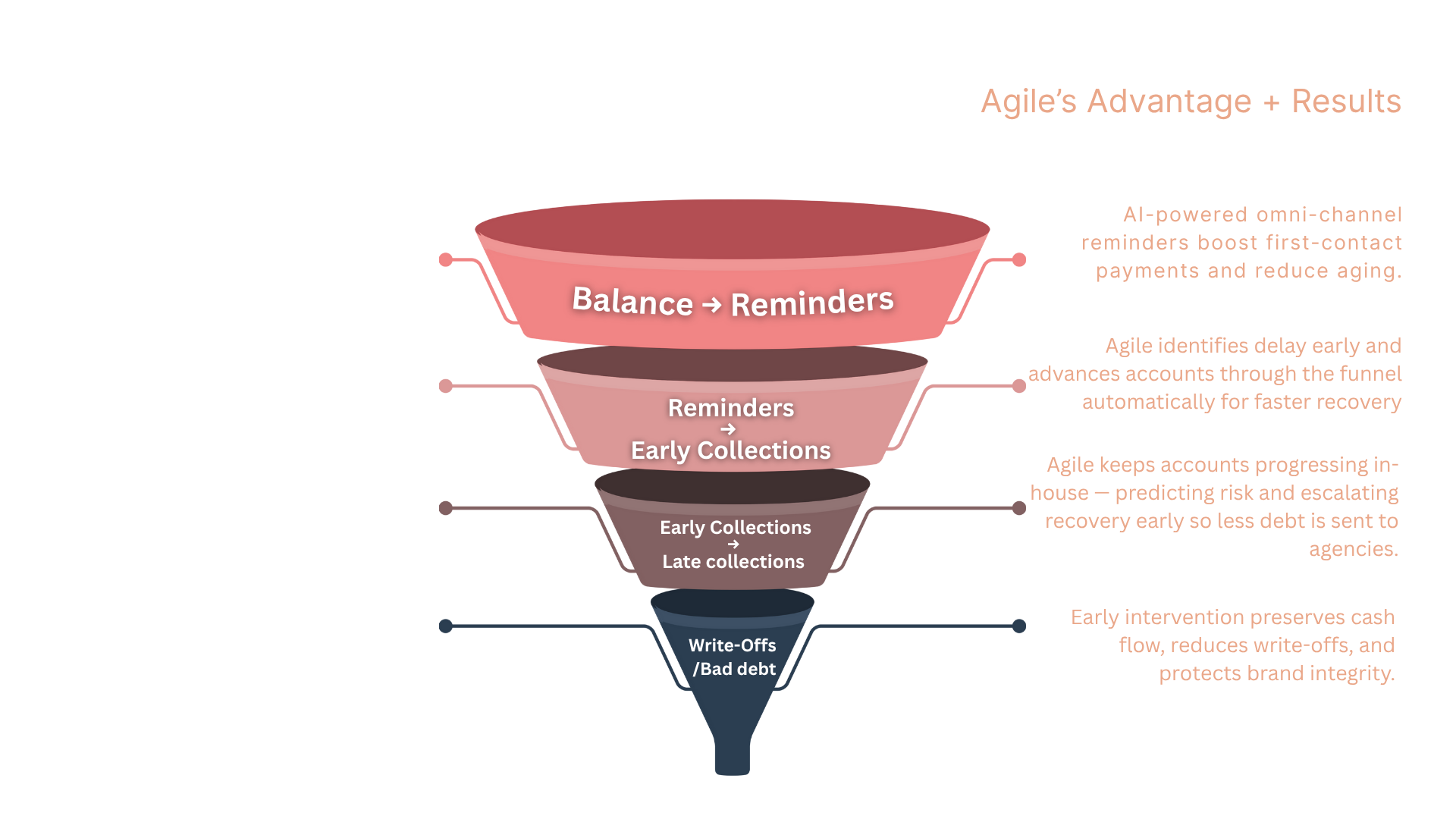

Balance → Reminder

Industry Reality

Many balances go unpaid due to delayed or limited outreach.

Agile Advantage + Result

AI-driven omni-channel reminders boost first-contact payments and reduce aging.

Reminder → Early Collections

Industry Reality

Effectiveness drops after 90 days and manual effort increases.

Agile Advantage + Result

Unified messaging and self-service payments lower DSO and reduce manual touches.

Early → Late / 3rd Party

Industry Reality

Recovery rates fall sharply; external collection costs rise.

Agile Advantage + Result

Predictive risk detection and automated escalation increase in-house recoveries and cut agency reliance.

Late / Legal → Write-Offs / Debt Sale

Industry Reality

Accounts reaching charge-off recover very little and damage margins.

Agile Advantage + Result

Early intervention preserves cash flow, reduces write-offs, and protects brand integrity.

From The Founder

Rethinking How the World Gets Paid

Agile Receivables was founded by Kunal Sadhre, who spent nearly two decades shaping credit, collections, and revenue strategies for Fortune 500 companies.

Across industries, he saw the same problem — finance teams juggling disconnected systems, manual workflows, and too many vendors just to manage receivables.

His solution wasn't another collection tool — it was smarter software. Agile Receivables unifies communication, payments, automation, and analytics in one cloud-based platform, replacing multiple tools with a single intelligent system that helps businesses recover revenue faster and maintain lasting relationships.

Agile Receivables — Simplify payments. Unify systems. Accelerate cash flow.

Our Mission

Most businesses don't struggle to find overdue accounts — they struggle to reach and engage customers efficiently. Multiple vendors, manual workflows, and outdated systems slow payments and hurt relationships.

Agile Receivables changes that. We unify outreach, payments, and collections in one seamless workflow — improving cash flow, visibility, and customer experience.

The Modern Receivables Reality

Finance teams today are expected to do more with less — managing thousands of accounts across disconnected systems. The result? Missed payments, slow follow-ups, and rising bad debt.

Agile Receivables replaces multiple tools with one intelligent, cloud-based platform that automates communication, payments, reporting, and compliance — helping businesses recover more, faster.

The Ripple Effect

Disconnected systems don't just delay payments — they create drag across the entire organization:

- Increased bad debt

- Higher compliance and operational strain

- Fragmented customer experience

- Rising cost to collect

The Agile Mindset

"Receivables recovery isn't about pressure — it's about precision, timing, and intelligent communication."

Agile Receivables turns complexity into clarity — automating receivables across industries to help companies get paid faster, easier, and smarter. One platform, built for scale, combining outreach, payments, analytics, and compliance in a single, seamless experience.

Kunal Sadhre

Founder & CEO, Agile Receivables

Powered by AI

Agile learns from every interaction — adjusting timing, channel, and tone to drive faster payments.

Learns from Behavior

AI analyzes customer interaction patterns to optimize communication timing and payment success rates.

Perfect Timing

Automatically determines the best moment to reach out based on historical data and customer behavior.

Adaptive Channel Selection

Chooses the most effective communication channel for each customer — email, SMS, or voice.

AI Driven Voice Calls

Intelligent voice automation that adapts conversation flow based on customer responses and payment history.

AI Generated Templates

Creates personalized, persuasive email and SMS content tailored to each customer's payment situation.

Secure by Design. Compliant by Intent

Agile follows SOC 2, HIPAA and PCI DSS to keep your data protected—today and as we scale towards full certification.

Industries We Serve

Agile serves businesses across diverse industries, helping them optimize receivables management and streamline operations.

Tailored Pricing for Every Business

Every business is unique — and so is your receivables process

Agile's pricing is customized based on your volume, automation needs, and communication preferences. Whether you need invoice-to-reminder automation, early-stage collections, or both — Agile lets you choose what fits your business, so you only pay for what you need.

Quick Response

Our team will reach out within 24 hours to learn about your goals and provide a plan that fits your workflow.